New support for crowdfunded micro-loans + four businesses receive financing

Recently closed loans

The Northland Foundation closed on four loans totaling $475,000 to support northeast Minnesota small businesses. They are:

- Bali Asian Cuisine, LLC, Duluth

- Grumpelstiltskin’s Fiber Mill, LLC, Culver

- El Oasis del Norte, LLC, Hermantown

- First Strike Safety Solutions, Inc., Duluth

To learn more about Business Services and loan tools available, please email our Business Services Director, Michael Colclough.

New service designed to increase access to capital

Free support for entrepreneurs to crowdfund microloans

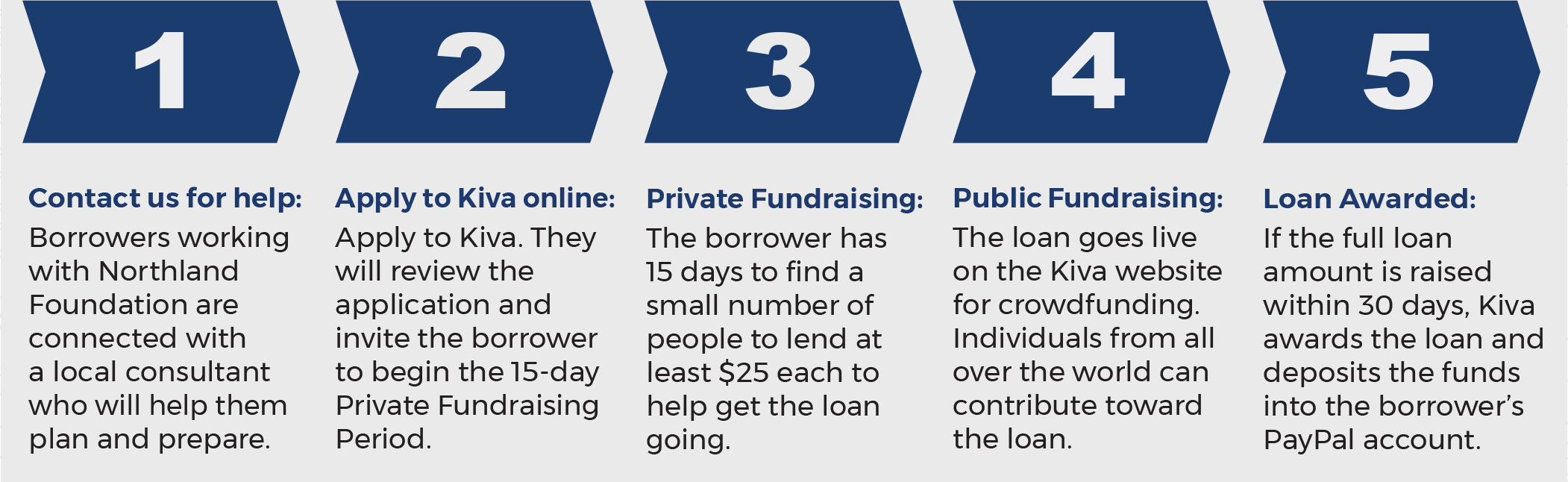

The Northland Foundation has partnered with Kiva, a non-profit working in the microloan space, to help more small businesses in our region successfully access capital to start, sustain, and grow. Kiva uses a unique online crowdfunding platform.

Loan amounts range from $1,000 – $15,000 at 0% interest with a repayment term of up to 3 years. Loan agreements and repayment terms are managed directly by Kiva.

“As a Kiva Trustee, we help answer entrepreneurs’ questions and, for those who seek our support, connect them to a Northland SBDC consultant. The SBDC works with the borrower to complete a one-page business plan, Kiva online ‘pitch’, and promote their loan once it appears on Kiva’s web platform,” explained Amanda Vuicich, Small Business Lender. “We may also be able to match funds to help them reach their loan goal amount.”

The program helps entrepreneurs access a more sustainable funding option for growth than payday lenders or other predatory lending schemes.

“We were looking for a way to provide small loans to entrepreneurs who may not qualify for financing from traditional sources.” said Michael Colclough, Business Services Director. “This is a promising option.”

More about the process

What is the timeline from application to funding? After pre-application work is completed with the help of a local Northland SBDC consultant, the entire process takes between 45 and 60 days to complete.

What niche in the local financing landscape will Kiva help fill? Northland’s Kiva program will help fill the gap of small loans under $15,000 for entrepreneurs from all walks of life. This program will help advance Northland Foundation’s work around equity and belonging by making capital available to more entrepreneurs who are Black, Indigenous, of Latin or Hispanic heritage, Asian, or other people of color, and other under-served entrepreneurs. Because Kiva loans don’t require a strong credit history, collateral, or equity, it’s also an option for anyone who may have those types of barriers to securing traditional loan sources. Kiva does conduct online research on the borrower’s business and their social networks.

Can a Kiva loan be used as part of a capital stack for a project larger than $15,000? Absolutely! Kiva loans can be standalone financing for a project or be part of a larger funding package in partnership with traditional and nontraditional lenders.

How to get started

Download a flyer, visit NorthlandKiva.org for important details and to fill out an online Intake Form, or email Amanda Vuicich, Small Business Lender.