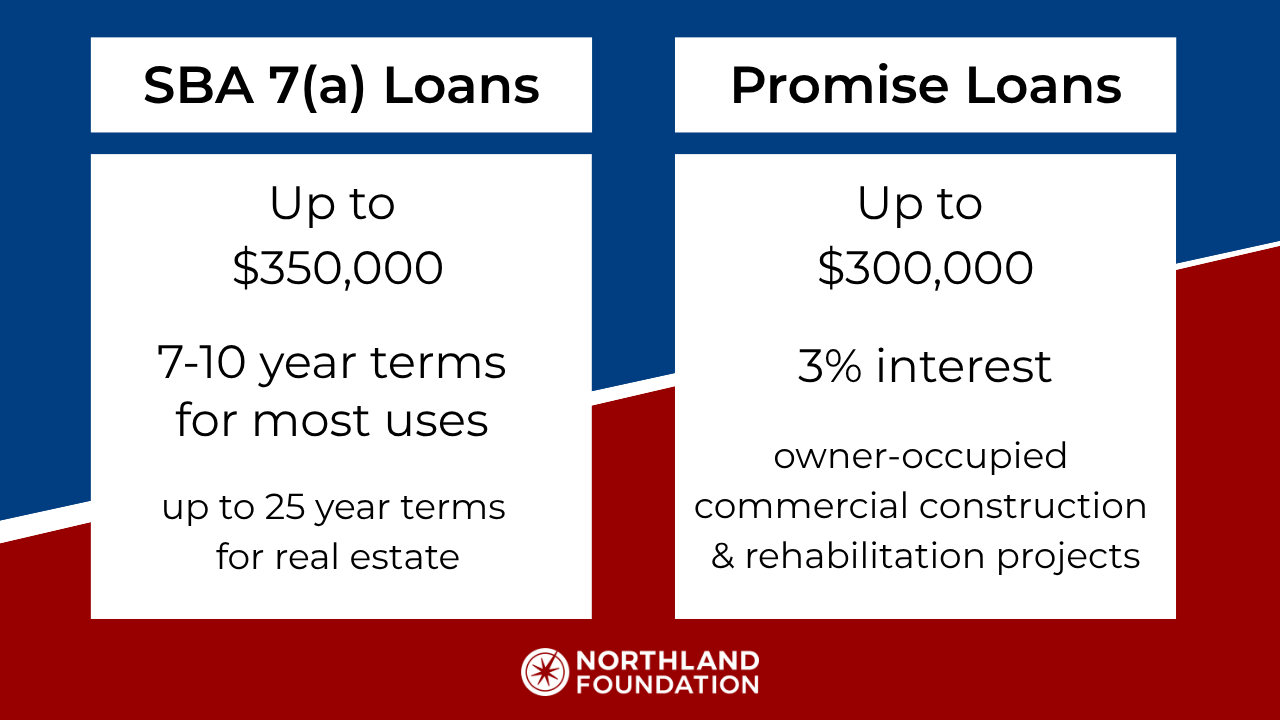

Flexibility & rates: loan tools for growth

Minnesota Promise and SBA Loans offer flexibility and opportunity for small business borrowers

For more than 35 years, the Northland Foundation has been on the side of entrepreneurs and business owners, and robust nonprofit organizations, playing a role in small business success. As a mission-driven, non-traditional lender, we’re here to support a thriving, inclusive business ecosystem where access to capital isn’t limited by geography, identity, or financial barriers.

Whether a borrower is ready to launch a new venture or needs the wherewithal to grow an existing one, we work hard to say yes. Our staff are passionate about what they do (they like working with numbers!) and finding a path to financing for our borrowers, even when it’s not easy, is their jam. Two of the numerous tools at their disposal are SBA and Minnesota Promise loans.

SBA 7(a) loans open opportunities up to more borrowers

The SBA 7(a) Loan Program is the Small Business Administration’s primary business loan program. It provides loan guaranties to lenders like the Northland Foundation that allow us to finance small businesses with unique requirements. It is a favorable option for many business borrowers, including those who might otherwise have a tough time qualifying for a loan or one large enough to meet their needs. Terms are competitive, and borrowers with limited collateral or credit histories can still be eligible.

Loans cap at $350,000. Terms are 7 to 10 years for working capital, inventory, business acquisition – including partial buy-in by an employee, start-up expenses, or tenant improvements, and up to 25 years for real estate. 7(a) loans can be used for:

- Changes of ownership (complete or partial)

- Acquiring or improving real estate and buildings

- Working capital

- Purchase and installation of machinery and equipment

Promise Loans offer rock-bottom rates for eligible borrowers

The State of Minnesota’s Promise Loan Program, in which we are a participating lender, offers low-interest capital to established business borrowers for commercial construction to expand or rehab/improve their owner-occupied site.

Interest is just 3% for loans up to $300,000. This state program is aimed at eligible borrowers that have less than $1 million in revenue. Promise Loans can be used for:

- Land Acquisition, Development, Redevelopment

- Equipment

- Demolition, Site Preparation

- Predesign, Design, Engineering

- Repair, Renovation of Real Property, Capital Improvements, Relocation

If you’re curious about SBA, Promise, or our other loan products available to businesses and nonprofits in our region, reach out to Amanda Vuicich or Michael Colclough. You can also find more information on our website.

Business borrowers fund growth with Northland Foundation financing

The Northland Foundation was pleased to close on financing with three northeastern Minnesota borrowers. They are two existing businesses, one in Virginia and one in Duluth, and a Duluth-based nonprofit organization.

- Stimac Properties, LLC, d/b/a Arrow Auto Glass and Door, Virginia

- American Indian Community Housing Organization (AICHO), Duluth

- Ursa Minor Brewing, LLC, Duluth

Are you a small business, aspiring business owner, or a bank or credit union seeking to partner or refer clients? Get in touch by emailing Michael Colclough, VP of Business Services, or Amanda Vuicich, Small Business Lender. We’re here to help!