Client story and recently closed loans

Eye Clinic North

Third-generation local optometry practice expands Iron Range facilities to keep pace with eye care in Northeast Minnesota

| The owners of Eye Clinic North, third-generation practitioners on the Iron Range and in Duluth, have a clear vision for the future of their medical optometry practice and retail eye care. Dr. Matthew Sipola and Dr. Hannah Sipola have dramatically increased their practice’s physical footprint, improved accessibility for the diversity of people they serve, and expanded their staff team. A new construction office in Hibbing opened in late 2023. Then, this month, they cut the ribbon on a bigger site in Virginia. Eye Clinic North also has a Duluth location. Matt’s father and grandfather both practiced here, and Matt says he knew from the 10th grade that he wanted to follow in their footsteps. After he and Hannah concluded their training and residencies in 2015, Matt was eager to come back home to northeast Minnesota. The couple are among a small number of Minnesota optometrists who are board certified in medical as well as general optometry, improving their ability to help treat and manage diseases and injuries of the eye as well as provide eye exams, glasses, contacts, and safety glasses. “Demand for health care is growing across the board, yet the number of providers, especially in rural areas like ours, is not,” said Matt. “Half a dozen Iron Range eye care providers have retired or moved in the past five years or so and not been replaced,” he added. The Sipolas have invested significantly in their business and their communities to help fill the gap. Adding new equipment and leading-edge treatments, bringing Dr. Kayla Bechthold and her practice into Eye Clinic North, and relinquishing their too-small downtown locations for new spaces has equipped them to serve more patients, more comfortably and efficiently. |

| “The former offices had no room to grow. Hallways and restrooms did not fit wheelchairs and exam space was limited. We had to turn patients away,” Matt explained. “Across our two new sites, we’ve more than doubled our footprint and are fully ADA compliant, too.” Growth has not come without challenges. A week before the Hibbing construction was to start, it was learned the site sat atop a former dump. Testing revealed soil contamination, and suddenly the Sipolas were faced with undertaking (and fronting the costs of) a clean-up. The schedule slipped way behind. But, they had strong support behind them. “I was on the phone a ton with Mike (Colclough), our banker, the City. We all learned a lot and figured things out including getting help to pay for the remediation,” said Matt. Many agencies assisted in the clean-up, including the Iron Range Resources and Rehabilitation Board, Minnesota Department of Employment and Economic Development, Arrowhead Regional Development Commission, Arrowhead Economic Opportunity Agency, and the City of Hibbing. The project received a 2024 Minnesota Brownfields ReScape Award recognizing innovation, collaboration, and exemplary results in revitalizing formerly contaminated land. |

“Northland Foundation was a big part of financing for our Hibbing build and were there again working with us and our bank when we needed an equipment loan to complete the Virginia remodel. Having them on our side made a huge difference,” Matt stated.

Now that they’ve cut the ribbon on their Virginia office (shown here with Northland Foundation’s Amanda Vuicich and Michael Colclough during the Virginia ribbon cutting in January), the Drs. Sipola are excited to put construction and remodeling aside and be back to focusing fully on patient care.

Michael Colclough, Northland Foundation’s Business Services Director, is also pleased to see the Sipola’s vision realized.

“We worked closely with Matt and Hannah on a financing solution tailored to their expansion goals,” Colclough said. “Their commitment to building on a family legacy and making care accessible to more people made this project an exciting one for us.”

Find out more about Eye Clinic North services and their three locations at eyeclinicnorth.com.

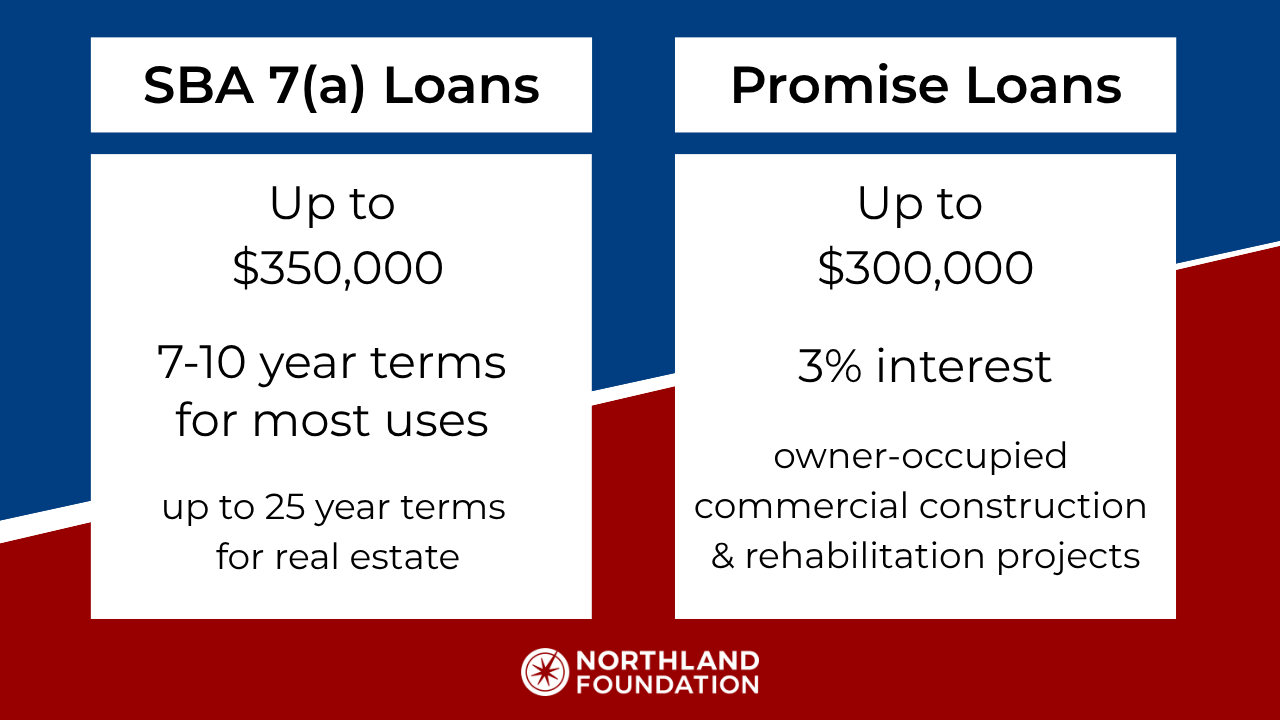

More than $1.1 million in loans support five small businesses in the region

The Northland Foundation has closed five business loans in recent months providing $1,138,000 in financing in the region. Borrowers include the 112-year-old Sunrise Bakery in Hibbing, Healing Hands, a chiropractic and wellness business in Grand Rapids, Wild State Cider in Duluth to expand its footprint and add a kitchen, Cook County Real Estate Fund (CCREF) for the development of 36 new units of housing in Grand Marais including 18 units designated for workforce housing for people earning 80 percent or less of area median income, and Newday Housing to expand housing for disabled veterans in Duluth.

- Healing Hands Chiropractic Center, Grand Rapids

- Sunrise Bakery, LLC, Hibbing

- Big Hill, LLC d/b/a Wild State Cider, Duluth

- CCREF Hwy 61, LLC d/b/a The Heights, Grand Marais

- Newday Housing, Duluth

To learn more about Business Services and all the financing tools available, please email Amanda Vuicich or Michael Colclough.